Our trip to Switzerland – How much did we spend?

We spent seven weeks on our trip to Switzerland, leaving on 28th August and returning on 16th October. In the course of our journey we: Stayed in five different countries… Read more »

We spent seven weeks on our trip to Switzerland, leaving on 28th August and returning on 16th October. In the course of our journey we: Stayed in five different countries… Read more »

I always like to look back on our trips and work out what they cost us. I think this may feel alien to some, but for me this helps me… Read more »

09/03/2023 It’s been a long time since Bertie had a big adventure! When we returned from our two years of travel in 2019 we aimed for another five years of… Read more »

It’s been an odd year to say the least. COVID has certainly curtailed our travel in Bertie the motorhome, but I think I can take that on the chin given… Read more »

I have to admit that the F.I.R.E movement had completely passed me by until recently. F.I.R.E stands for Financial Independence; Retire Early and has been around for some time, but… Read more »

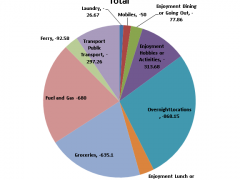

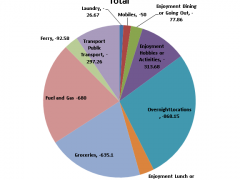

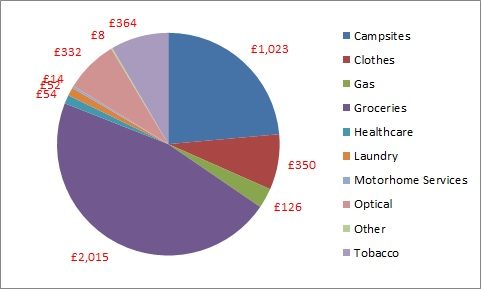

On the 8th May 2019 it was our second anniversary of moving out of our family home and starting our travels in Bertie the motorhome. Just like last year we… Read more »

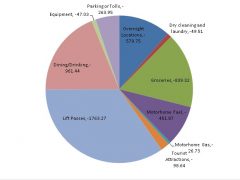

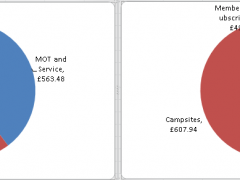

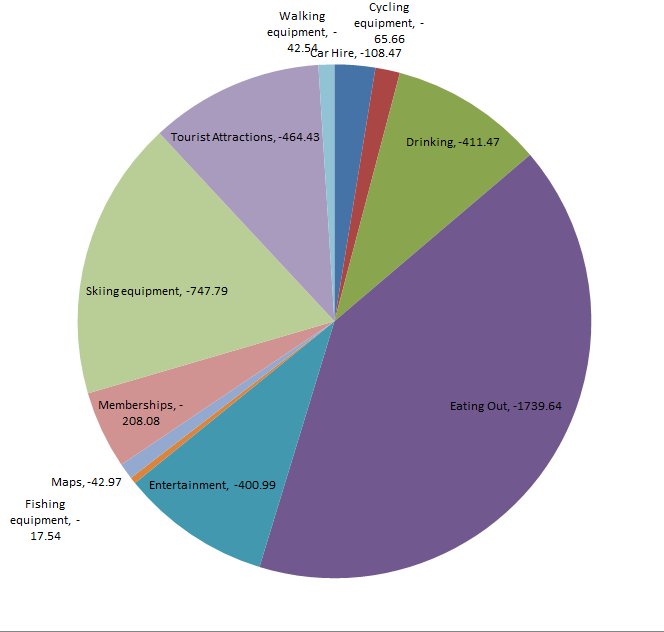

We have spent the past three months skiing from our motorhome. Now that we have finally packed the skis away it is time to do the totting up. How much… Read more »

When we think to hard about it we are slightly bemused by our decision to spend a lot of time skiing. Skiing is not a budget activity and we are… Read more »

When spending in a foreign country there are lots of different factors to consider, exchange rates might vary widely depending on where you change your money, banks might charge fees… Read more »

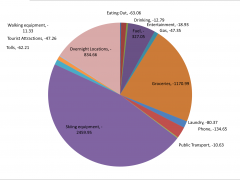

We are now one year into our motorhome life. On the 8th of May 2017 we moved out of our house in Exmouth, our tenants moved in and we started… Read more »

This morning Facebook reminded me that I received my formal notice of redundancy a year ago today. Although I had known about my impending redundancy for some time (I was… Read more »

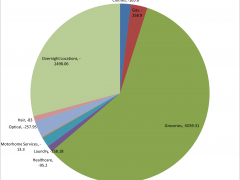

As we are now on the continent, we though it might be useful to summarise how we got on with travelling around the UK in our motorhome. You can read… Read more »